Cash Out & Refinance Loans

Cash Out Refinance Loans on Investment Properties

Refinance Loans

American Heritage Lending is a direct lender providing cash-out refinance loans to real estate investors and property owners. Cash-out refinance loans are the fast and easy option for real estate investors looking to take equity from an existing investment property to reinvest the funds elsewhere. Cash-out refinance loans on an investment property can provide real estate investors with liquid funds within days. They can then use the cash out refinance loan proceeds to purchase a new investment property quickly.

General Terms

- Single or multiple rental properties

- Up to 80% of value

- $75,000 to $2 million

- Purchase or Refinance

- Income calculated on the property, not the borrower

- Fixed or Adjustable options on 30 year terms

Our Refinance Loan Parameters:

Property Types

SFR, Condo, Apartment Complex

Loan Amounts

$75,000 – $2,000,000

Term

6 months to 30 years – interest-only, partially-amortized, and fully-amortized loans available.

Loans Available

Loans are available to individuals, trusts, corporations, and limited partnerships.

Common Refinance Loan Scenarios

Situations for cash-out refinance loan scenarios include, but are not limited to:

- Free and Clear Property

- Purchasing another property

- Crossing another Property

- Paying for Tenant Improvements

- Paying for Rehab Work on a Distressed Property

Be it a property you recently acquired and need to pull out money for another transaction quickly; our cash-out refinance loan is designed to get you the money necessary for your business purpose needs.

There is no limit on the number of properties.

American Heritage Lending Cash-Out Refinance Loans

We offer interest-only and term loans for up to 30 years on our cash-out refinance loans, allowing you to choose a payment schedule that best fits your needs.

We originate cash-out refinance loans on all types of commercial properties. If for any reason, you do not qualify for a traditional commercial mortgage loan, American Heritage Lending is the lender of choice for the RE Investors.

We are as good as cash. With no limits on the number of properties, you can leverage one property or your entire portfolio.

Our customized cash-out refinance loan programs allow you to get a loan that best suits your needs.

?

How a cash-out refinance loan works

In cash-out refinance loans, you refinance an existing mortgage loan for a larger amount than the original mortgage. The difference between the original loan and the cash-out refinance loan results in cash, based on the refinanced equity. American Heritage Lending can expedite the process, getting you the cash you need immediately. Our rates for cash-out refinance loans are lower than the average interest on credit cards, making American Heritage a far better option for your business.

Cash-out loans for business purposes are one of the most common loan scenarios we see today.

With traditional lenders limited to strict loan parameters, American Heritage Lending is the top lender in the market, focusing on equity over borrower financials. This gives our clients the liquidity needed for their individual situations. Our underwriting guidelines for cash-out refinance loans focus on equity, not borrower income. We have originated cash-out refinance loans for borrowers with low credit scores, prior bankruptcies, and foreclosures. Call us if a bank turns you down for a cash-out refinance loan!

We can often provide you with same-day prequalification on a cash-out refinance loan. Please complete our Loan Interest Form below to get started.

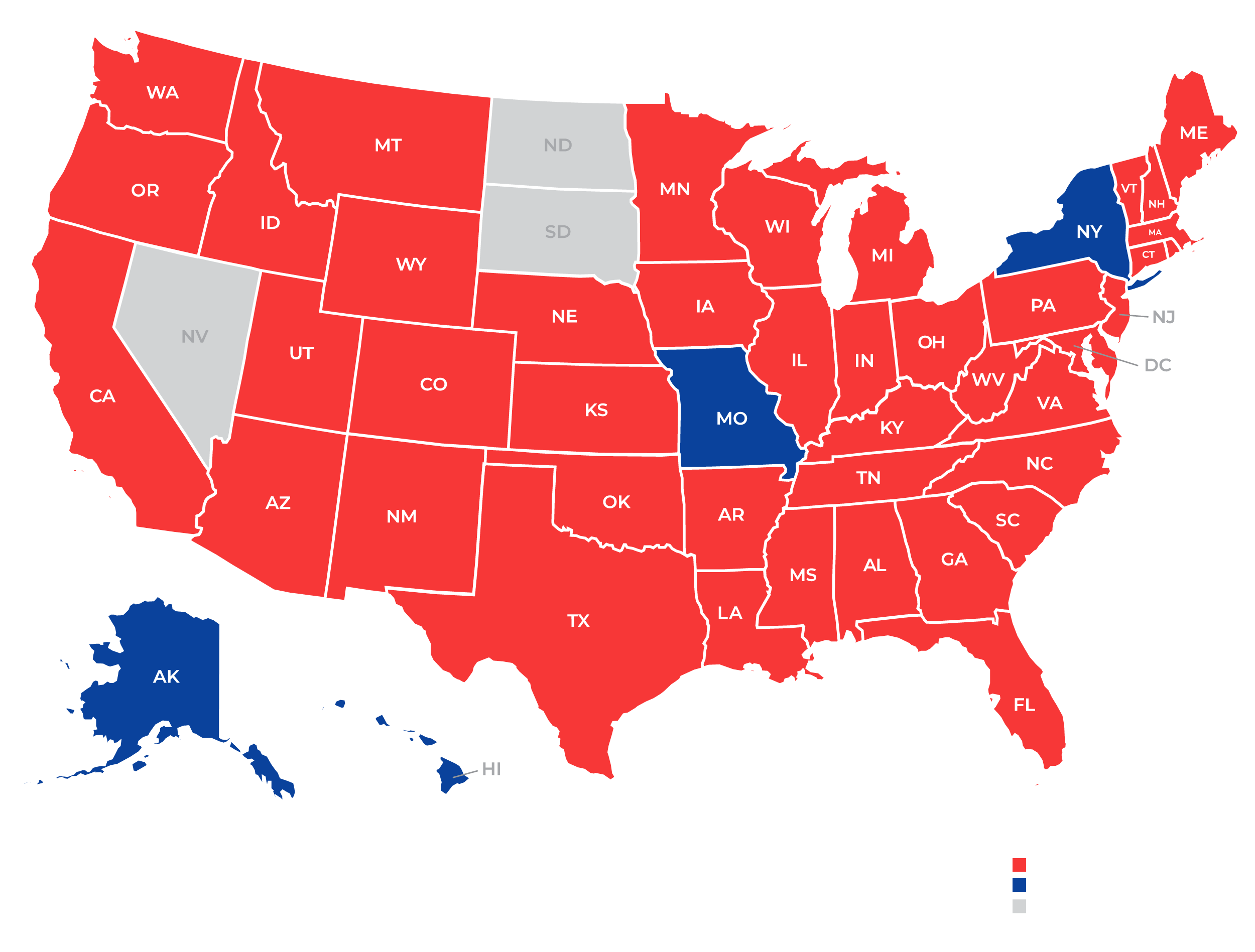

States We Lend In